Click Here to Begin the Loan Application Process

The Loan Fund will be accepting applications from small businesses beginning August 1, 2024.

Translation services are available upon request. Los servicios de traducción están disponibles bajo petición.

We understand that owning your own business can be tough work, that’s why we offer business development counseling to make sure you have the resources to be successful. We offer technical assistance (coaching, advising, etc.) such as business strategy, cash flow forecasts, marketing, etc. Whether it’s a scholarship for training, an introduction to a business leader or assistance in setting up a bookkeeping system, NCI is committed to working with our clients to make sure they have the tools for success. This technical assistance is available to prospective applicants, current applicants, and current borrowers.

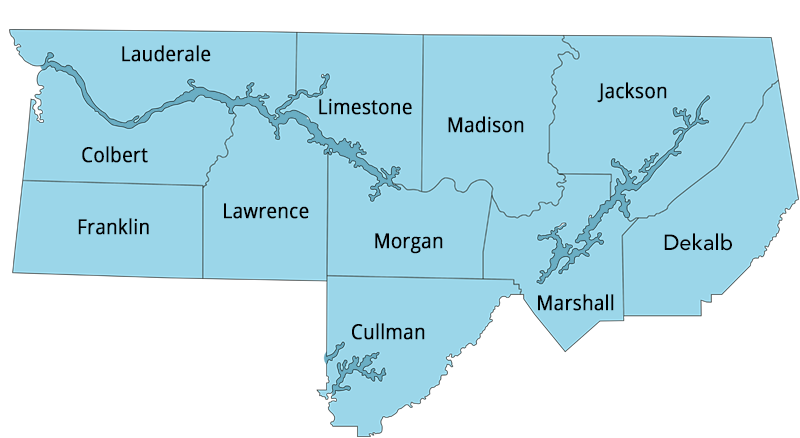

Our business advisory services coupled with our lending activities provide businesses with the business tools they need to grow and transition to more traditional sources of financing. Loans are available to businesses located throughout north Alabama with preference given to businesses in underserved communities within these counties.

Initial funding for the Loan Fund was made possible with generous grants from the Food Bank of North Alabama and from the City of Huntsville.

We recognize that no two businesses are alike, our staff will take the time to carefully review your application and your needs.

Loans are available to businesses located in Colbert, Cullman, DeKalb, Franklin, Jackson, Lauderdale, Lawrence, Limestone, Madison, Marshall and Morgan counties. Preference is given to businesses in underserved communities within these counties.

In accordance with federal law and U.S. Department of the Treasury policy, this institution is prohibited from discriminating based on race, color, national origin, sex, age, or disability. Submit a complaint of discrimination, by mail to U.S. Department of the Treasury, Office of Civil Rights and Equal Employment Opportunity, 1500 Pennsylvania Ave. N.W., Washington, D.C. 20220, (202) 622-1160 (phone), (202) 622-0367 (fax), or email This email address is being protected from spambots. You need JavaScript enabled to view it..

De acuerdo a lo establecido por las leyes federales y las políticas del Departamento del Tesoro esta organización no puede discriminar por causa de raza, color, origen nacional, sexo, edad, o porque una persona tiene impedimentos. Para presentar una queja sobre discriminación, escriba a: U.S. Department of the Treasury, Office of Civil Rights and Equal Employment Opportunity, 1500 Pennsylvania Avenue, N.W., Washington, DC 20220; llame al (202) 622-1160; o envíe un correo electrónico a: This email address is being protected from spambots. You need JavaScript enabled to view it..

In 2015, NARLF received U. S. Treasury certification as a Community Development Financial Institution, opening up additional opportunities to positively impact the North Alabama economy.